In the past weeks, the cryptocurrency world has been shaken by a sensational event. Terra (LUNA) Coin, which provides blockchain services such as Bitcoin and Ethereum, has almost hit the bottom. What caused this deep dive of Terra (LUNA), who suddenly found himself in the almost zero position from $100. Why did the transactions not stop this decline? To find answers to these questions, let’s first examine the Terra (LUNA) project.

Terra (LUNA)

South Korean firm Terraform Labs, founded by Daniel Shin and Do Kwon in 2018, started trading on the Terra blockchain to develop lower-cost financial network management that is free from the current financial order.

Terra is a fully digital, decentralized finance company backed by its own token Terra (LUNA) and stablecoin UST. Terra (LUNA), which offers its users the opportunity to return with interest, provides a monthly income of 20%.

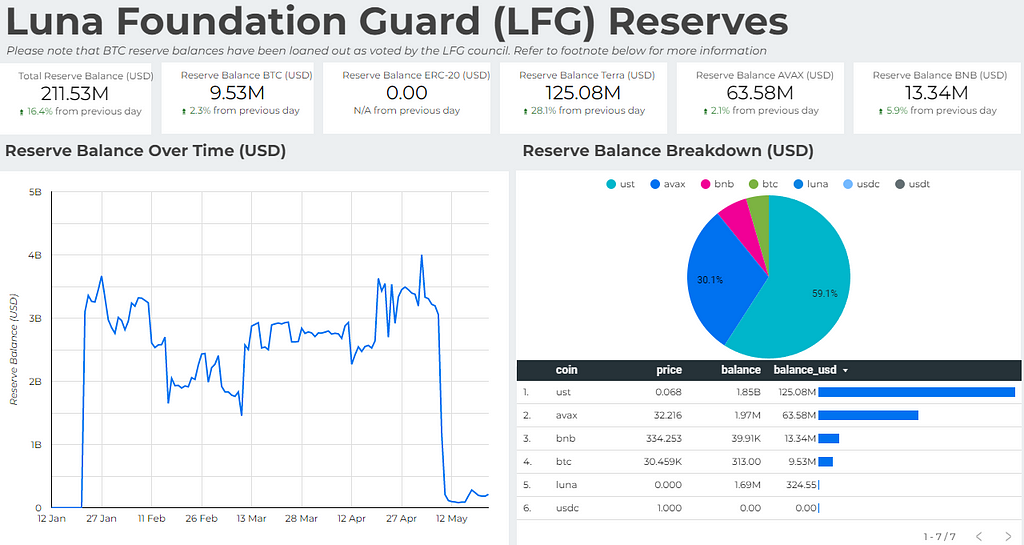

To finance the network, company executives must hold reserves. This reserve is Bitcoin, altcoin, and fiat money and is kept to be used when necessary. At the same time, new positions are determined and investments are made to increase the number of reserves.

Terra (LUNA) uses the UST stablecoin based on the current exchange rate. It backs UST with Terra (LUNA) to keep it at $1. To achieve this, it produces or burns Terra (LUNA) depending on the amount of supply. Terra (LUNA) has an unlimited supply.

How Did The Collapse Begin?

Many cryptocurrency investment experts say that we are in a mini bear period in the cryptocurrency exchange. During this period, many cryptocurrencies fell along with Bitcoin. The decline in cryptocurrencies accelerated as the FED announced its interest rate decision at the beginning of May and predicted an increase in interest rates in the coming periods.

Do Kwon, CEO and co-founder of TerraLabs, announced his Bitcoin reserves and stated that they determined a new level of 1 billion dollars during this period.

After these developments, the sales boards on the cryptocurrency exchanges remained empty for a long time.

Attacks Were Started

Investors, called Whales in the exchange, started selling their large amounts of UST on high-volume exchanges such as Binance and FTX. The reason for the start of the sale is that the CEO of Terra company bought 80.393 Bitcoin to increase his reserves and his new interest policy decision. Terra managers, who started selling their Bitcoin reserves to keep the UST stable at $1, caused panic among investors.

With the movement of this Terra (LUNA) 42.500 Bitcoin in the wallet, the attacks became more intense and panic sales began. With the Bitcoin sales melting the reserves, the AVAX reserves have also decreased by half. Despite the sales, delists continued in many cryptocurrency exchanges. Terra (LUNA), which should support the UST, dropped below $1 in a very short time from $100.

Network Was Stopped

As the attacks continued, the Terra (LUNA) network was halted. After a 9-hour wait, the network, which started block production again, could not get enough support and was stopped for the second time by the administrators with the statement “to find a plan to rebuild the network” in block 7607789. According to the statement made on Terra’s official Twitter account, the network has started working and blocked production again.

What will happen now?

There are thousands of projects on the blockchain. Some of these projects are successful. CEO of DO Kwon stated in a broadcast he attended that many projects will fail. Do, which is waiting for the support of the investors to get out of the current situation, seems to have failed to give the necessary confidence to the investors.

Among the rescue plans that Do Kwon announced, the most striking was the bifurcation. However, most of the community, including the Binance CEO, agree that this idea will not work.

Binance has reopened the LUNA/BUSD trading pair. After this list opened, Terra (LUNA) was offered to switch to tht BNB network.

According to CoinMarketCap data, Terra (LUNA) is currently trading at $0.0001862 and UST at $0.06735.

NitroEx Mobile Application is live on 📲 iOS and 📲 Android.

Join NitroEx Official Telegram

Follow us on Twitter